Chapter 4

The Business Model

Revenue Generation: Selling Learning Material and Evaluation Fees

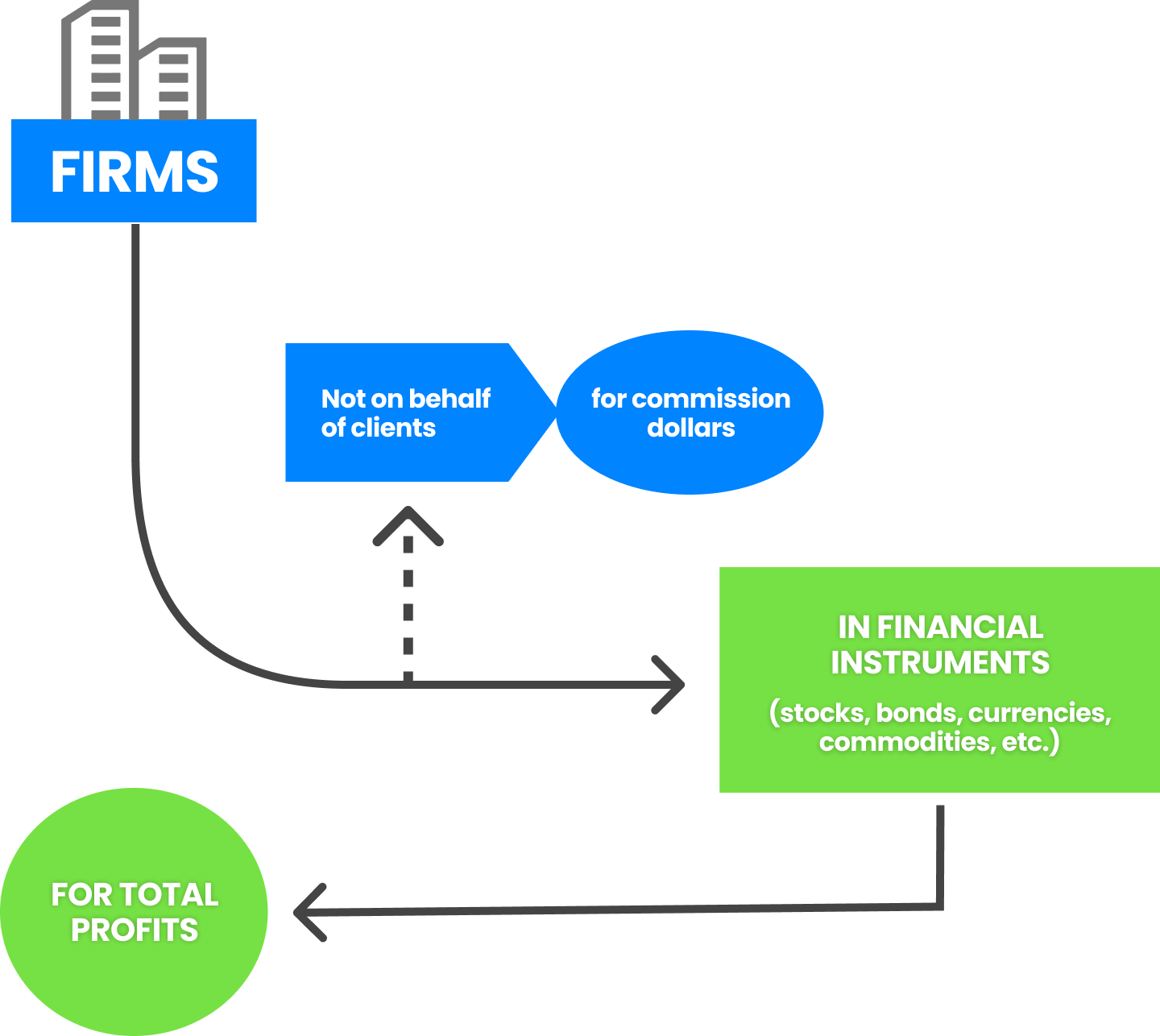

A prop firm invests directly in financial instruments, such as CFDs on stocks, forex, futures, options, and cryptocurrency. This model is unlike brokers that take clients' funds and trade on their behalf. The graphic below illustrates the typical workflow of a prop firm.

The workflow does not represent the business model. As mentioned in the introduction, prop firms differ based on strategy and the asset class they focus on. Some prop firms trade a single asset class (i.e., stocks) on a single exchange, while others explore a multi-asset strategy on the global financial market. In other words, prop firms have unique business models, and the only common divisor is the focus on retail traders whom they fund and share profits with.

Nevertheless, prop firms tend to follow a specific technique in their operations. A typical prop firm business model has three primary elements through which the business generates revenue – selling learning material, evaluation fees, and profit sharing.

The Importance of Professional Training for Prop Traders

Unlike regular retail trading, proprietary trading is high stakes primarily because it involves huge amounts of capital. A typical prop trader starts their career with approximately $15,000 capital in a live account. This amount of money is a lot, meaning the trader must have proper market knowledge to make any profit. Cognizant of this fact, most prop firms require new traders to undergo professional training – this may come before or after the evaluation process.

Professional training might include a psychology course – to evaluate the suitability of the trader's mental faculties, an introduction to prop trading, and advanced trading. Some firms take the training a notch higher by teaching a combined course and running specialized programs, such as Audacity Capital's Hidden Talents Programs. Most firms sell the training materials, generating substantial income.

Evaluation Fees and the Path to Live Accounts

The second element of the revenue model is evaluation fees. Different firms implement a unique scale for evaluation fees, although some do not charge fees. Prop firms that do not charge evaluation fees include The5ers, Topstep, SurgeTrader, City Traders Imperium, and more. Those demanding the fee apply them on a prorated basis – they apply the fee based on the account size.

For example, FX2 Funding has five account sizes for traders to choose from. The firm’s starter account is a $10,000 balance. Traders being evaluated at this level pay a $125 one-time fee. The next level is Intermediate, with a $25,000 account size and a $315 one-time fee. The Professional level follows, with a $50,000 account size and a $500 one-time fee. The second highest level is Expert, with a $100,000 account size and a $900 one-time fee. At the apex of mastery is the Master tier, with a $200,000 account size and a $1,800 one-time fee.

Unlike FTMO and Audacity Capital’s two stage, time limited evaluation, FX2 Funding takes new traders through a single simplified challenge for the evaluation process.

Although all prop firms promise live accounts for all traders, most rarely do that. Instead, they choose to mirror a small percentage of their profitable traders' positions. However, there are unique firms like FX2 Funding that give all their traders live accounts. For example, suppose a new trader joins the FX2 Funding platform. Once they impress in the evaluation test, the firm directly enrolls them in the Starter level and opens a live account with $10,000 in trading capital. The trader will have only two conditions to keep his account active: (i) do not lose more than $400 per day, and (iii) keep the maximum drawdown above $500.

You have completed chapter 4 of 10. Please answer the question below to continue to the next chapter.

I prefer to continue without answering

Fill in the form below to start your trading journey off right with the prop firm that puts traders first.