What possibilities does $1,000 bring? Well, that depends on where you live. In countries like the US or EU, it might not get you much in terms of purchases, but it can kickstart your journey towards financial independence through trading.

Believe it or not, you can start forex day trading with $1,000 or even less. It requires mastering position sizing and managing risks, but if you navigate your way to success, the rewards can be significant. In this article, we will discuss in detail how you can day trade with $1000.

Understanding Day Trading

Day trading involves buying and selling financial assets within the same trading day to profit from short-term price movements. Key principles include identifying patterns, trends, and market volatility to execute timely trades.

Successful day traders possess a combination of analytical skills, discipline, and risk management strategies. They must be able to interpret market data rapidly and execute trades with precision. Emotional control is also critical, as day trading can be stressful and emotionally taxing. Continuous learning and staying updated on market trends are essential for staying competitive in this fast-paced environment. It is also important to master trading psychology tips to deal with the psychological challenges of trading.

Benefits of Day Trading

- Day trading allows traders to capitalize on short-term fluctuations in the market, enabling them to potentially earn profits within a single trading session. By identifying and acting on these movements quickly, day traders have the opportunity to generate income on a more frequent basis compared to long-term investors.

- With the ability to execute multiple trades in a day, day traders have the potential to achieve higher returns than traditional investors who hold positions for longer periods. This potential for increased profitability is attractive to individuals seeking to grow their wealth more rapidly through simple trading strategies.

- Day trading offers flexibility and independence, allowing traders to work from anywhere with an internet connection. This freedom enables individuals to set their own schedules and manage their trading activities around other commitments, providing a level of autonomy not found in traditional employment settings.

Day Trading Forex or Stocks

New traders frequently ask, "Is it possible to day trade for a living with only $1,000?" While $1,000 might not suffice for day trading stocks due to limited buying power, the forex market offers a different scenario. Many forex brokers set their minimum opening balance requirement at just $100, making it feasible to begin day trading with $1,000 in forex.

Leverage

Day trading forex has a big advantage over trading stocks: leverage. Forex brokers give more leverage because the forex market is busier than the stock market. Leverage means the broker lends the trader extra buying power.

For example, with $1,000 and 30:1 leverage, a trader can control up to $30,000 worth of assets. This can make profits much bigger, but it also means losses can be much bigger too. So, while leverage can help make more money, it's also risky.

It's important for traders to understand the risks of leverage before using it. They need to be aware of both the potential rewards and dangers to make smart trading decisions.

How to Start Day Trading with $1,000?

Starting day trading with $1,000 requires careful planning and strategy. The first step is to choose the right broker and trading platform. Look for a reputable forex broker that offers low commissions, competitive spreads, and user-friendly trading platforms. Ensure the broker supports micro-lot trading, allowing for smaller position sizes suitable for accounts with limited capital.

Once you've selected a broker, it's essential to develop a trading strategy. Define clear rules based on your risk tolerance, trading style, and market preferences. Test your strategy using a demo account to gain confidence and refine your approach before risking real money. Having a well-defined strategy will help guide your trading decisions and increase your chances of success.

Effective risk management is crucial when day trading with low capital. Set a maximum risk per trade, typically ranging from 1% to 3% of your account balance, to limit potential losses. Use stop-loss orders to automatically exit losing trades and prevent excessive drawdowns. Diversifying your trades across different currency pairs can also help spread risk.

Establish realistic expectations for your trading journey. Understand that day trading with $1,000 is challenging, and success won't happen overnight. Focus on consistency and gradual account growth rather than aiming for unrealistic returns. Be prepared for setbacks and losses along the way, and stay committed to continuously learning and improving your trading skills.

How much can you make with $1000 in Forex?

In this article, we'll explore two methods for building a $1,000 trading account:

- Using your own funds

- Joining a proprietary trading firm

1. Day trading with your own money

Let's discuss the first method: day trading with your own money.

To illustrate, let's consider Mister A, who has been practicing on a demo account for the past year. Over nearly 1,000 trades, Mister A averages about 1.5 trades per day with a 52% winning rate. He risks 1% of his capital on each trade, with an average reward-to-risk ratio of 2:1, meaning for every two dollars he gains, he loses one.

In his excitement to start day trading, Mister A opens a $1,000 account with a broker. Here are his key stats:

- Trades per month: 33 (1.5 per day with 22 trading days)

- Winning percentage: 52%

- Risk per trade: 1%

- Reward-to-risk ratio: 2:1

Based on these stats, his expectancy formula for the first month is:

$20 per win x [33 trades x 52%] - $10 per loss x [33 trades x 48%]

= $343.20 - $158.4

= $184.80

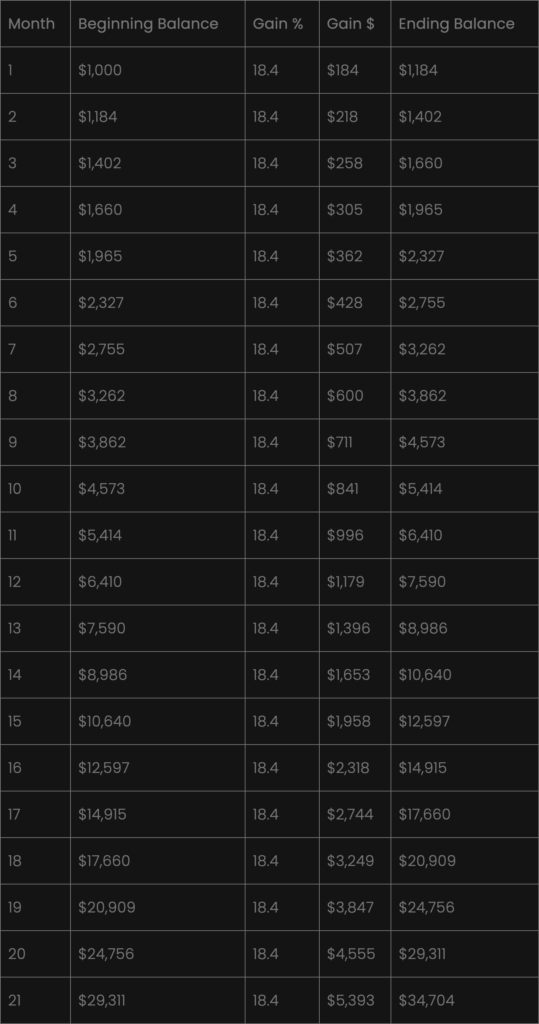

While a return on investment of 18% in one month seems impressive, Mister A only made $184.80. Let's examine how his equity will grow if he consistently achieves this 18.4% return per month without withdrawing any funds from his account (assuming compounding occurs at the end of each month).

According to the table above, Trader A consistently compounded his account each month, resulting in a profit of $5,393 by the 21st month. Comparatively, the average US household expenses in 2020 amounted to $5,011. Therefore, if Trader A sustained such exceptional trading performance (18.4% per month equating to a 220% ROI per year) and maintained discipline by refraining from withdrawing any funds for 21 months, he could utilize his accumulated profit in the 21st month to cover his expenses.

2. Day trading with a firm like FX2 Funding

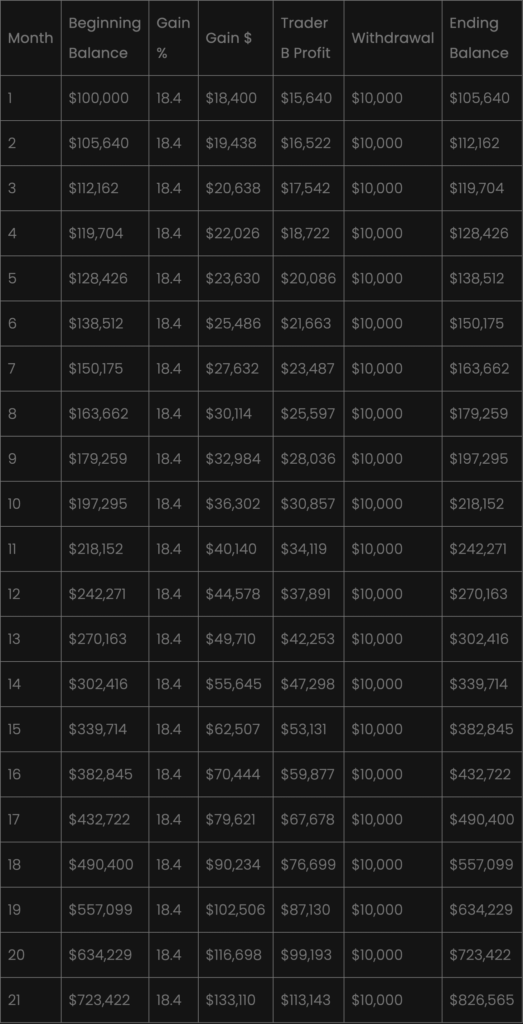

Let's imagine Trader B, who shares the same stats and success as Trader A after 12 months of trading with a demo account. Instead of opening a $1,000 account with a broker, Trader B invests the $1,000 to purchase a $100,000 evaluation with FX2 funding. Within two weeks, Trader B earns a 10% profit and successfully passes the evaluation. Now funded with a real $100,000 account, Trader B achieves an impressive $18,400 profit within just one month. While this amount is substantial enough to sustain a living, let's explore two hypothetical scenarios for further insight.

In the first scenario, Trader B opts not to withdraw any profits for 21 months, similar to Trader A's approach.

In the second scenario, Trader B decides that $10,000 is sufficient for living expenses and withdraws this amount monthly for the first 21 months, totaling $210,000. The remaining funds are left in the account to continue growing.

The tables below demonstrate Trader B's outcomes:

Scenario 1: No Withdrawals

Trader B's account grows to more than $286,000 by month 21, trading a $1,800,000 account.

Scenario 2: Monthly Withdrawals:

Despite withdrawing $10,000 per month for the first 21 months (totaling $210,000), Trader B still earns over $113,000 by month 21, trading a $723,000 account.

Clearly, Trader B, whose percentage gains mirror Trader A's, is in a far superior position. These remarkable advantages underscore the benefits of trading in a funded account with a proprietary day trading firm like FX2 Funding.

Check out FX2 Funding today to see how you can get funded just like Trader B.