Trading gold requires an advanced approach that incorporates technical and fundamental analysis. Understanding the complexities of XAU trading is crucial for success, regardless of experience level.

In this article, we'll look at useful tactics, important signs, and priceless advice to help you manage the gold market and the gold trading techniques. We’re going to explore everything from how to trade xauusd to the pros and cons of gold trading. Let’s get started!

Source

Pros and Cons of Gold Trading

Some pros of gold trading are as under:

- Throughout periods of both economic and geopolitical uncertainty, gold has historically been a secure place for investors. As a buffer against inflation and the market downturn, the value of this asset usually increases when the rest of the assets are struggling.

- Gold works well as a diversification strategy due to its low connection with other assets. Gold can lower overall risk and increase long-term profits.

- There are strong trading volumes in the gold markets around the clock, and they are quite liquid.

- As an actual physical asset with inherent value, gold differs from stocks and bonds.

Whereas some cons of Gold trading are:

- Even though gold is frequently regarded as a safe haven, there can be volatility in its price. For short-term traders, abrupt price swings could be difficult.

- In contrast to stocks or bonds, gold cannot generate revenue. Since the gold doesn't generate interest or dividends, holding it could have a cost of opportunity.

- Counterparty risk is present when purchasing gold through ETFs or derivatives. Investors can lose money if the issuing institution defaults.

- The taxation and limitations on imports and exports of gold, among other government laws and regulations, can affect the liquidity and profitability of gold assets.

What Does Gold Trading Involve, and Which Factors Move Prices?

Buying and selling gold by means of financial instruments such as futures contracts, ETFs, or CFDs is referred to as gold trading. Gold may also be sold physically. The market is always accessible to dealers and is open to them globally 24/7. But the best way to trade gold is usually when there's a lot of liquidity and volatility, which usually occurs throughout the same trading hours in major cities like Tokyo, New York, and London.

The price of gold is affected by a large number of variables like the value of the US Dollar, US interest rates and traders’ risk on/off sentiments. Let’s discuss these factors in detail:

Value of the US Dollar

The US dollar is extremely important while trading gold. There is no formal or established relationship between the prices of gold and the dollar, even though they frequently seem to be at odds because of economic and investment sentiments.

When the US dollar appreciates compared to other currencies throughout the world, gold prices frequently decline in terms of the US dollar. The reason for this is that gold's value increases in relation to other global currencies.

Source

US Interest Rates

Interest rates have no bearing on the price of gold. In the long run, supply and demand determine it, just like they do for the majority of basic commodities.

Demand is ultimately more powerful than supply, even though increases in supply have the potential to drastically lower the price of gold. Since it takes ten years or longer to turn a discovered gold resource into a producing mine, the amount of gold supply varies slowly. Because rising interest rates are usually negative for stocks, they may be bullish for gold prices.

Traders Risk On/Off Sentiments

Investors often seek safe-haven assets like gold to safeguard their investment during risk-off periods that are characterized by heightened uncertainties, geopolitical risks, or economic instability. Faced with market turmoil, this "risk-off" positioning shows that investors turn to safe havens.

When investors shift their funds to more growth-oriented investments, this "risk-on" mentality usually puts downward pressure on gold prices. Thus, it is critical for traders to comprehend changes in risk mood in order to predict gold price swings and modify their trading tactics appropriately, whether by leveraging risk appetite in stable markets or looking for safe havens during turbulence.

Is Trading Gold the Same as Trading Currency in Forex?

Trading gold and money in the FX market have some parallels, but they are also separate experiences. Forex market becomes the place where currencies circulate with each being given its own value based on economic factors, political conditions, and market trends.

However, trading gold shares some similarities with the gold world, where the magnetism of gold dominates. The value of gold is influenced by factors that include global demand, inflation, and political instability rather than the wellbeing of an economy in a particular country. It is often seen as a safe haven during times of uncertainty; therefore its price movements reflect broader market sentiment. Trading gold may appeal to people who want stability and a real asset, but forex trading offers a fast-paced environment with a diverse range of currency pairs to explore.

Source

Tips on Developing a Winning Gold Trading Strategy

A profitable gold trading strategy involves both research, analysis, and risk management. Here are some tips:

- Study the factors that govern the price of gold, for example, geopolitical occurrences, economic indicators and market emotion.

- Use charts and some indicators to find trends, support and resistance levels, and entry/exit points.

- Monitor the macroeconomic factors like inflation, interest rates, and movement of currency that influence gold prices.

- Establish risk limits such as stop-loss orders and position size to protect your capital.

Gold Trading Hours: Best Time to Trade XAUUSD

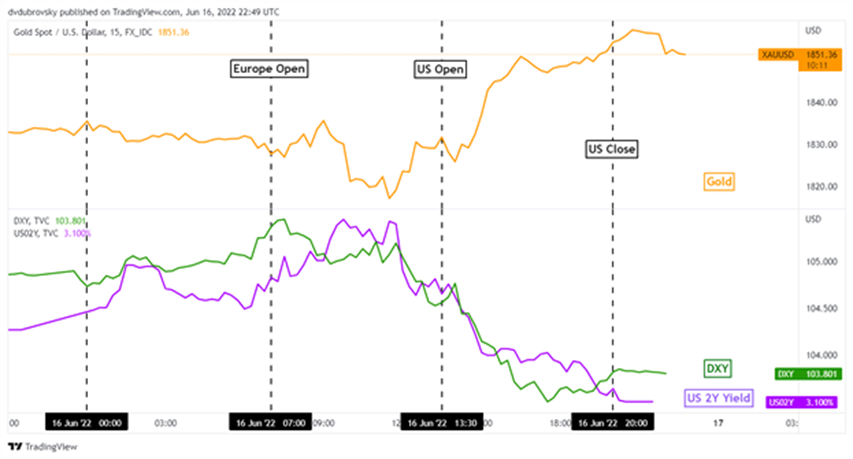

An instance of high liquidity and volatility in the forex market typically signals the ideal time to trade the most traded currency pairs of gold (XAU) against the US dollar (USD), or XAUUSD. When the primary trading sessions, mainly the European and US sessions, overlap, that is when XAUUSD trading strategy is at its most beneficial. There is an increase in trading activity and liquidity during this overlap, which occurs between 8:00 AM and 12:00 PM (UTC), when both US and European traders are engaged together. This is considered as the best time to trade gold.

The increased volume and tighter spreads during this time could assist traders through enhancing trading opportunities and cutting transaction costs. The XAUUSD pair experiences more volatility during these trading hours due to the regular occurrence of significant economic data releases, central bank statements, and geopolitical events.

What Is the Best Trading Gold Futures Strategy?

Your trading style, degree of risk tolerance, and the state of the market contribute to the best future gold trading techniques. Below are some of the most used strategies:

Position Trading Strategies

Position trading in Gold relates to the creation of longer term positions on the basis of general market patterns and fundamental analysis. Trend following, in which traders seem to profit from prolonged price fluctuations in the direction of the dominant trend is an effective strategy for position trading in gold. Technical indicators such as trend lines and moving average, can help traders spot and validate trends so they can initiate positions accordingly.

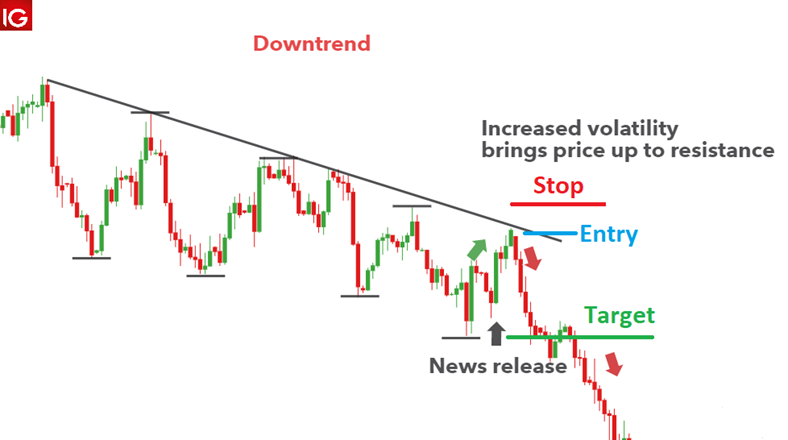

News Trading Strategies

Using forex news strategies, traders of gold try to profit from short-term price swings by taking advantage of news events that move the market. When employing this technique, traders keep a close eye on events that might impact gold prices, such as central bank declarations, economic indices, and geopolitical happenings. Traders move fast to profit from the ensuing market volatility when important news is released.

Source

Trend Trading Strategies

Profiting from long-term shifts in prices in the market is the primary goal of trend trading strategy in the gold trading sector. With this strategy, traders seek to capitalize on the momentum of current trends, whether positive or negative. Finding and validating trends in the gold market can be accomplished.

As a demonstration of an upward trend, traders can search for circumstances in which the price of gold regularly rises over time, both at higher highs and lower levels. Trades may go long once a trend is noticed with the intention of profiting from it as it progresses.

Day Trading Strategies

You must be wondering how to day trade gold? By using day trading strategy, you can profit from short term price swing by placing many traits in a single trading day for gold. Scalping involves traders entering and quitting positions fast in an effort to profit from minor price movements. This is a popular method for day trading gold. Helpers might find short term opportunities in the gold market by using technical indicators like moving averages, Fibonacci retracements, all levels of support and resistance.

Source

Price Action Trading

When it comes to trading gold, price action trading is all about analysing and selecting your actions based only on the price movements of gold on the charts. Traders that use this approach believe that the price itself reflects all pertinent information about the market. To identify possible trade centres, they keep a close eye on patterns, candlestick formations and levels of support and resistance.

It takes perseverance, self-control and an in-depth understanding of market dynamics to trade price action.

Copy Trading Strategies

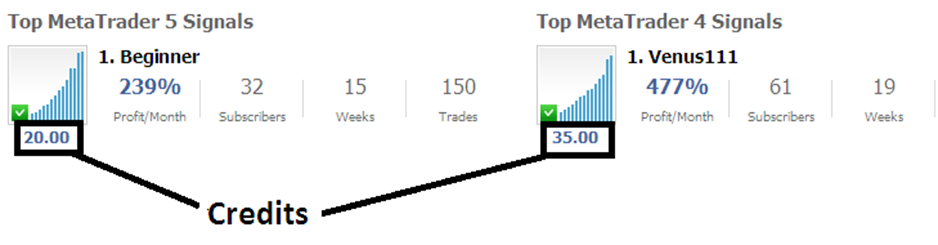

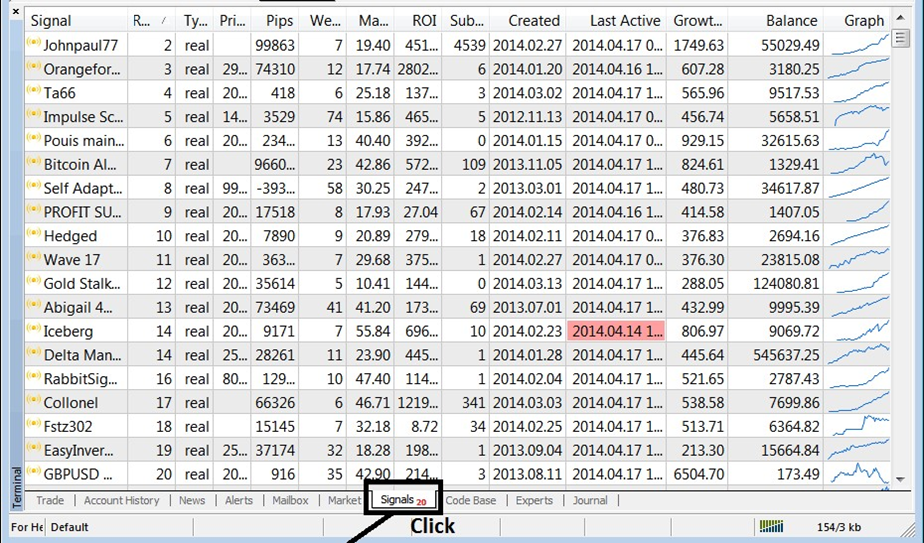

For gold trading, the copy trading method involved automatically copying traders created by trader's algorithms of successful traders. Those who are new to trading or lack the time and expertise to conduct their own market analysis may find this method particularly helpful. Investors that use copy trading can select a trader or algorithm whose performance they want to emulate, and their traders will be right away copied in their own account.

Copy trading platforms offer a variety of experienced traders or trading algorithms that have specialization in trading gold. Investors can evaluate each provider’s previous performance's risk profile and trading approach before selecting who to imitate. After choosing a provider, all credit completed by the provider is mirrored in real time in the investor’s account.

Source

What Are the Best Indicators to Use for Gold Trading?

When it comes to Gold trading, selecting the best gold trading indicators might be similar to choosing the proper tools for the job. Let’s discuss some of the best indicators below:

Relative Strength RSI Indicator

The relative strength index (RSI) is like having a personal coach for your Gold trading adventures. This forex gold indicator analyse the strength and speed of price swings in the gold market, guiding you to possible buying or selling opportunities. When the RSI reveals that cold is overbought, which means it has risen too rapidly and set up for a pull back, it may be a good moment to consider selling. On the other hand, if the RSI suggests that gold is oversold, employing that price has been fast declining and maybe due for a rebound, this could indicate a buying opportunity. However, the RSI, like any coach, is not perfect. It is important to apply it in combination with other tools and analysis to verify your trading selections. By implementing the RSI into your gold trading strategy, you get another essential tool in your toolkit that will help you navigate the market's turns and twists with more confidence.

Moving Averages Indicator

In the gold trading market, think of the shifting averages indicator as your trustworthy guide. Moving average can help you navigate the ups and downs of gold prices in the same way that GPS can for new highways. These indicators smooth out fluctuations in prices over a specific time-period, giving you an improved understanding of the overall trend. While the moving average cannot predict the future, they do provide helpful insights into market trends allowing you to make better choices when trading. By implementing moving averages into your gold trading strategy, you are adding a reliable instrument to the arsenal enabling you to cope with the ups and downs of the gold market with more trust.

Bollinger Bands

Consider Bollinger bands as a partner in the gold market, constantly monitoring the rotations in the market. These bands provide important information about the volatility and possible price fluctuations of gold by acting as dynamic boundaries around the metal's price. Based on changes in the market, the upper and lower bands enlarge and contract to represent times and prices have moved higher and lower.

Bottom Line

The secret to successful gold trading is keeping up expertise, self control and flexibility. Pay careful attention to any changes in geopolitics, economic statistics or market movements that may have an impact on gold prices. Stick to your trading strategy, managing risk through position sizing and stop loss orders. As the market conditions change, be ready to adjust your strategy.

Remember that consistency and well-informed decision making over a long amount of time are essential for success in the gold trading sector.

Also, visit our store listed on https://www.wethrift.com/fx2-funding