Forex swing trading, an impatient and accurate dance, draws on market waves with measured moves that produce timely returns.

If we ask what is swing trading in forex? In simple words, Forex Swing trading is capturing short to medium term gains by maintaining positions for days or weeks. Swing traders, compared to day traders, aim to profit more long-term market swings. Successful strategies for profiting from market swings frequently involve technical analysis, trend identification and risk management. In this article, we will discuss tips and strategies for swing trading in forex.

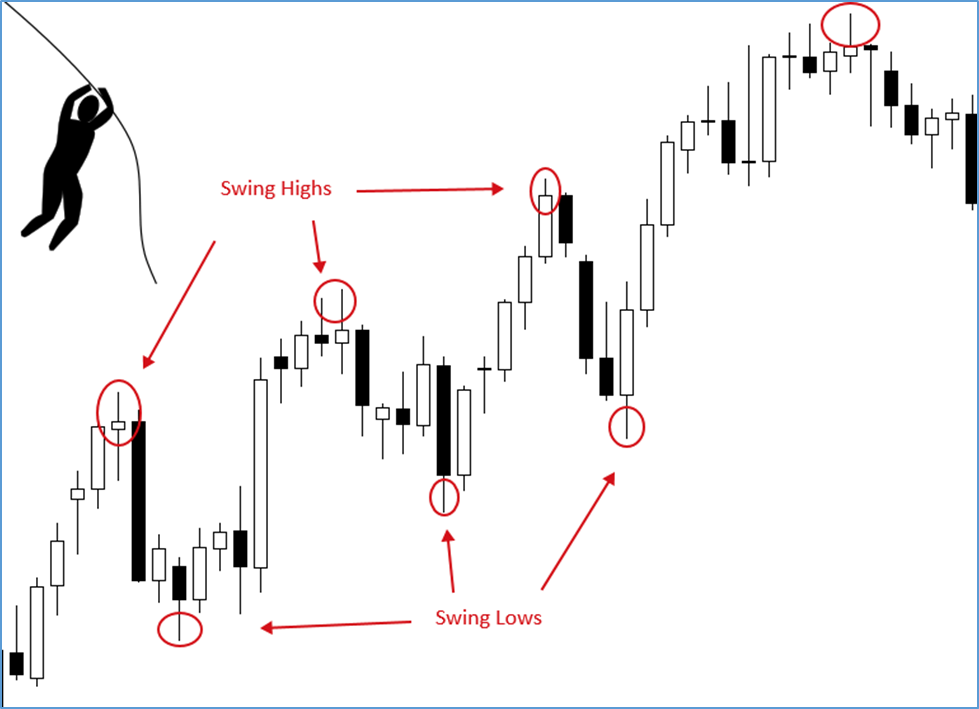

How Swing Trading Works

Swing trading builds on short to medium term market swings. Traders utilize charts and patterns to determine potential entry and exit spots. They try to catch swings in prices by buying low and selling high, or selling short and buying back lower. Effective risk management and discipline are essential for achievement.

If we focus on the method on how to swing trade? Then we must make sure to trade effectively, analyze chart patterns, identify essential support and resistance levels, and place trades with good risk-reward ratios.

The main idea of swing trading is to get into the trade when a new trend or swing starts and ride the wave until exhaustion or correction kicks in. For instance, if a market were moving up, swing traders would wait for the market to correct slightly and enter a buy position at the swing low in anticipation of price bouncing and swinging high in continuation of the underlying uptrend.

Source: Babypips.com

Similarly, if the market moved lower, a swing trader would wait for the price to correct and bounce back slightly to enter a short position at a swing high. By selling at a swing high, a trader will look to accrue significant pips as the price moves lower in continuation of the underlying downtrend.

Whereas, Forex swing trading signals provide clear guidance on ideal entry and exit positions, helping traders in exploiting opportunities for profit in the currency markets. A forex swing trading strategy involves recognizing trends, checking technical indicators, and initiating plates with the aim of benefiting from medium terms price swings. The best forex swing trading strategy is to learn how to identify a trending market. This way, you can earn more profit from short to medium term price movements in the currency markets.

Pros and Cons of Swing Trading

Swing trading gives multiple benefits for traders who seek profit from short to medium term market swings.

1. Swing trading allows traders to profit from significant price swings in a relatively short length of time. Traders may make larger profits by holding positions for days to weeks, as compared to long-term investment strategies.

2. Swing trading offers more freedom than day trading, which demands typical market monitoring. Traders may discover about the market, execute trades, and track positions at their leisure, making it suitable for those with a busy schedule.

3. Swing trading does not require the same time commitment as day trading. Traders may do extensive research, execute trades, and monitor positions without having to remain hooked to their screens all day.

4. Swing trading prop firms offer growing traders access to funds and tools in exchange for a portion of profits, providing an encouraging environment for developing trading skills and implementing financial market tactics. These companies often have developed training programs, risk management processes, and performance evaluation systems in place to help traders survive in the competitive world of proprietary trading.

However, swing trading has its own set of obstacles and risks that traders must be aware of:

1. Traders are subjected to market quality, which can result in sharp price changes and greater risk. Sudden shifts in markets may result in substantial losses if positions are not properly managed.

2. Traders who hold positions overnight are subjected to overnight risk, which includes price gaps caused by news events or market mindset actions. Traders must be prepared for any gaps and their positions, which may result in unexpected losses.

Swing Trading vs Day Trading

Swing trading and day trading are two separate trading strategies, each with their distinctive strategy and features.

1. The main difference is the amount of time of position retention rates. Day traders open and reject positions on the same trading day in hope of profiting from intraday price movements. Swing traders, on the other hand, position for days or weeks to profit from short to medium term trends. This is also called position trading.

2. Day trading can be riskier due to the shorter holding period and increased exposure to market quality. Traders must use restricted risk management procedures to reduce potential losses. Swing trading, on the other hand, provides greater versatility in risk management strategies since positions are held for longer periods of time.

3. Day trading requires extreme focus and rapid decision-making, which can lead to increased stress and emotional trading. Swing trading, on the other hand, fosters a more balanced trading attitude by decreasing the need to constantly monitor the markets.

4. Day trading often requires larger capital input due to the need for quick trades and higher trading volumes. Swing trading may be more accessible to traders with limited funds because positions are held for longer periods.

The Best Time Frame for Swing Trading

The most suitable time frame for swing trading is chosen according to individual preferences and market conditions. Many swing traders employ daily or four-hour charts, which enable them to capture significant price swings without being overwhelmed by short-term changes. Select the time period that best suits your trading approach and goals.

Pass the prop firm evaluation with this super practical E-Book!

Would you like access to the insider secrets that most prop firms don’t want you to know?

Free Secure Download

The Best Indicators for Swing Trading

For swing trading, traders employ a combination of technical indicators to assist with their selections. Common indicators include moving averages MACD, RSI, and stochastic oscillators. These indicators help traders spot trends, momentum, and potential reversals, enabling them to time their entry and exit points for the best profit opportunities. Experimentation and modification are essential for determining the most effective indicators for your strategy.

Exponential Moving Average

The Exponential Moving Average (EMA) is a commonly employed technical indicator in trading. Despite typical moving averages, the EMA concentrates on present-day price data, permitting it to adapt to changes in price trends. EMAs are frequently employed by traders to determine trends, clarify entry and exit points, and track momentum.

The Exponential Moving Average provides valuable insight into the direction price is moving. It relies on the most recent data to affirm the prevailing momentum, making it a preferred fit for traders looking to trade swings in a given direction.

While the EMA determines future trends, it also signals potential entry levels. For instance, prices will always exceed the Exponential Moving Average whenever the market moves up.

Source: Tradingview.com

Therefore, a swing trader will look to enter a long position as soon as the price pulls back close to the moving average and does not close below. Likewise, the traders will exit the position as soon as the price closes below the moving average and moves lower, implying a trend change from uptrend to downtrend.

Source: Tradingview.com

The price will always be below the exponential moving average in a downtrend. Consequently, a swing trader could look to enter a short position as soon as the price pulls back close to the moving average. Conversely, the bounce back provides an opportunity to sell high, anticipating the price edging lower afterward.

Relative Strength Index

The Relative Strength Index RSI is a famous momentum oscillator in trading. It assesses the rate and change of price movement to decide if an investment is overbought or oversold. Traders utilize RSI to forecast probable trend reversals, confirm trend strength, and apply some trend trading strategies.

While the EMA provides valuable insight into the prevailing trend, the Relative Strength Index sheds more light on the momentum strength. The indicator comes with readings between zero and 100. Readings above 50 imply a buildup in buying pressure, signaling that the price will continue increasing. On the other hand, readings below 50 indicate a buildup in selling pressure, signaling price is expected to tank.

Source: Audacitycapital.com

In swing trading, traders look to enter a long position whenever the RSI reading is below 30 and shows signs of bouncing back and moving up. Any reading below 30 signals overbought conditions. Consequently, there is usually a high chance of the price bouncing back. As the RSI starts moving up, a trader can enter a long position and ride the swing until the RSI reading is above 70.

Likewise, whenever the RSI reading is above 70, a swing trader can look to enter short positions in the market to take advantage of the overbought conditions. The prospect of price reversing and moving lower is usually high.

Bollinger Bands

Bollinger bands are a technical analysis tool made up of a moving average (often the simple moving average) and two bands drawn above and below it. These bars represent the standard deviation of price movement from the moving average, which could suggest overbought or oversold situations.

The Bollinger Bands is one of the best swing trading forex indicators as it signals market volatility. The indicator has upper and lower bands with a median simple moving average. The price is expected to be close to the simple moving average in the middle during balanced market conditions.

Source: Tradingview.com

Swing traders look to take advantage of extreme volatility that causes the price to move and penetrate the upper and lower bands. Consequently, whenever the price rises and shows signs of penetrating the upper band, a swing tarred would look to enter a short position in anticipation of price correcting and moving lower to the middle simple moving average.

Likewise, a swing trader can look to enter a buy position as soon price penetrates the lower band, as there is usually a high tendency for it to bounce back and move to the simple moving average at the middle.

The Best Swing Trading Strategies

The most successful swing trading strategies include technical analysis, risk management, and market adaptability. Trend following, mean reversion and break out trading are a few of the most common tactics. A well-balanced collection of these tactics, suited to individual risk tolerance, time frame preferences, and market conditions can be the key to success. Experimentation and ongoing learning are critical to refinement.

Trend Following Using Moving Averages

Trend following utilizing moving averages is an accepted swing trading strategy. Traders use the moving average to identify and profit on trends, purchasing when prices are above the moving average and selling when prices go below it. This approach aims to profit from ongoing price swings while emphasizing patience and trend confirmation.

Trend following is an effective swing trading strategy as it allows traders to always be in sync with the market. In this case, swing traders use two moving averages, one fast-moving and another slow-moving. Consequently, one can use 21-period EMA as the fast-moving and 100 EMA as the slow-moving.

Source: Tradingview.com

The fast-moving EMA will respond to price changes. When it moves below the 100-EMA, it implies a shift in trend from uptrend to downtrend. A swing trader can use this opportunity to enter a short position. If the price remains below the 100 EMA and closes when it moves above the long-term EMA.

Similarly, a swing trader can look to enter a buy position whenever the 21 EMA crosses the 100 EMA and starts moving up. The crossover signals the start of an uptrend. A trader can leave the long position open to accrue gains if the price remains above the two EMA.

Reversal Trading or Fading the Move

Reversal trading, frequently referred to as fading the move, is a swing trading technique that trades against the present trend. Traders look for indications of exhaustion or overextension in market movements, anticipating a reversal. This strategy involves adopting positions opposed to the current trend with the goal of profiting from market downturns or trend reversals.

With this swing trading strategy, you must identify strong momentum into a resistance or support level. Look for a strong price rejection at this level with the formation of a bearish candlestick at the resistance or a bullish candlestick at the support. Once the candlestick forms look to enter a trade in the opposite direction of the underlying trend.

The EUR/USD chart below shows the price moving up in a steep uptrend. However, the pair hits a strong resistance and gets rejected the first time, consequently pulling back. Nevertheless, bulls try to engineer another move up but fail. Forming a bearish candlestick at the resistance level presents an opportunity to enter a short-swing trade.

Source: Tradingwithrayner.com

The best way to trade this price action is to enter a short position when a bearish candlestick emerges at the resistance level. A stop loss should be placed a few pips above the resistance level. The take profit should be before the nearest swing low.

Swing Trading Tips

Now that you understand the basics of swing trading, there are some things to always keep in mind. First, ensuring that trades align with the long-term trend is essential. Swing trading is much easier and more effective when trading with the trend. While there might be opportunities to enter reversal trades or fade the move, it is essential to use tight stop loss to avert the risk of incurring significant losses.

Secondly, it is essential to use Moving Averages as they help identify the prevailing trend. Moreover, they make it easy to always trade in the direction of the trend and exit as soon as conditions change.

Additionally, it is essential to use little leverage. When used appropriately, leverage can amplify profits. However, it is a double-edged sword that can also magnify losses.

Swing trading tips also involve prioritizing risk management to protect capital, adhering to trading tactics, and maintaining discipline during market downturns. Promote lifelong learning, adaptability, and patience. Prioritize quality above quantity in trading, and always do extensive research before implementing a position. Try to control your emotions and avoid making hasty decisions.

Is Swing Trading Right for You?

Swing trading can be an income-generating undertaking for those who have the necessary abilities, mindset, and resources.

1. Consider your distinctive features and risk tolerance. Do you have the fortitude and discipline to wait for attractive trade opportunities? Can you handle market turbulence without making emotional decisions?

2. Set trading goals and objectives. Are you pursuing short- to medium-term gains rather than long-term investments? Do you have specific financial goals or milestones you want to reach through trading?

3. Figure out your availability to devote to swing trading. Swing trading requires less time than day trading, but it still requires regular position monitoring and market analysis. Ensuring that you have plenty of time to do research and analysis.

4. Learn essential trading skills such as technical analysis, risk management, and making choices. Invest in materials for instruction like books, seminars, or mentorship programs to expand your knowledge and expertise in swing trading.

Lastly, successful swing trading requires a combination of patience, discipline, knowledge, and time commitment. Before engaging in swing trading, examine your personality, risk tolerance, trading goals, and accessible resources.

Bottom Line

In swing trading, the objective is to accomplish consistent profitability while properly controlling risk. Success includes an array of strategy, discipline, and adaptability to changing market conditions. Emphasize learning and refining, approach trading in an equitable way, and always keep long-term goals in consideration.